Setting up the SAP Finance Organization Structure is a crucial step in completing the overall SAP Organization Structure required to run scenarios across all SAP modules, including SAP MM (Materials Management), SD (Sales & Distribution), PP (Production Planning), and HCM (Human Capital Management).

--> You don’t need to be an SAP FI (Financial Accounting) consultant to complete this setup—just follow the simple steps in this guide, and you’ll have your SAP Finance Organization Structure ready in 5 minutes!

Table of Contents

1. Why We Need to Configure SAP Finance Organization Structure?

SAP FI serves as the financial backbone of your SAP system. Without a properly configured Finance Organization Structure, you won’t be able to fully integrate and execute transactions in other SAP modules. This setup is essential for:

✅ Ensuring seamless data flow between FI and other modules (MM, SD, PP, HCM, etc.)

✅ Maintaining accurate financial postings for procurement, sales, payroll, and production transactions

✅ Enabling real-time financial reporting and compliance tracking

✅ Avoiding errors and missing dependencies when running SAP business processes

2. Business of our Company

Our company manufactures cars in USA. Until now our company manufactured only diesel & petrol Cars, but to change with the time, our company has commissioned a new plant under a new company code which manufactures electric cars.

3. Structure of the company

We will configure SAP S4 HANA FI organization structure for our car business as per the picture below

4. Quick 5-Minute Configuration Steps-No FI Expertise Needed!

Just follow these Eight simple steps, and your SAP Finance Organization Structure will be configured in no time

Time needed: 5 minutes

How to Configure Basic FI Organization Structure in SAP S4 HANA in 5 Minutes in 8 easy steps

- Step 1: Define Company

Defined our both car companies in this step – “Pankaj Private IC Car INC” & “Pankaj Private Elect Car INC”

- Step 2: Define Company Code

“PA10” for “Pankaj Private IC Car INC” & “PP10” for “Pankaj Private Elect Car INC”

- Step 3: Assign Company Code to Company

PA10″ for “Pankaj Private IC Car INC” & “PP10” for “Pankaj Private Elect Car INC”

- Step 4: Define Variant for Opening Posting Period

PA10 Variant for PA10 Company Code & PP10 Variant for PP10 Company Code

- Step 5: Open and Close Posting Periods

Open & Close Posting period for both PA10 & PP10

- Step 6: Configure Chart of Accounts (COA)

COA PPIN – Pankaj Private Inc . Both PA10 & PP10 will use same Chart of Accounts

- Step 7: Enter Global Parameters for our Company Codes

Enter Global parameters for both PA10 & PP10 Company codes as shown in the respective section below

- Step 8: Create Controlling Area

We will create controlling area and assign this to our company code.

Note

You can download the excel file from the below link to copy paste the values of all the steps while doing configuration

💡 Watch this step-by-step tutorial to quickly configure the SAP Organization structure in 5 Minutes.

4.1 Step 1: Define Company

Defining a Company in SAP is a fundamental step in configuring the SAP Finance (FI) module, serving as the highest organizational unit for financial reporting. This setup is crucial for managing legal entities, consolidating financial statements, and ensuring regulatory compliance.

A properly defined company allows seamless Company Code assignments, ensuring smooth SAP FI-CO integration, intercompany transactions, and global financial management.

Businesses implementing SAP S/4HANA Finance can further enhance real-time consolidation, automated compliance tracking, and AI-powered financial insights for optimized decision-making

To define a company, navigate to Transaction Code: OX15, enter the Company Key, Company Name, Country, and Currency, and save the settings.

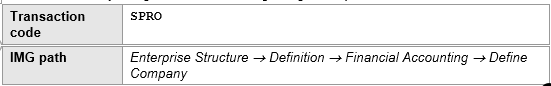

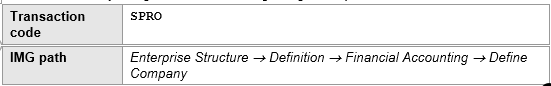

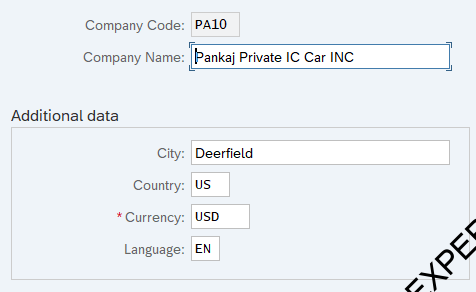

4.1.1. Company 1 – Cars with IC Engines

This company is named “PP IC car INC” is based in US near Chicago

| Co.Code | PA10 | Description-Pankaj Private IC Car INC | Address- Deerfield , Chicago | ||

| Plant-1 | PA10 | Description-PPIC Chicago Plant | Address-Lake cook Road, Illinois, 60089 | ||

| Plant-2 | PA20 | Description-PPIC Boston Part | Address-Cambridge, Boston, MA, 02139 |

4.1.1.1 Configuration of 1st Company in SAP S4 HANA

To configure the 1st Company as “PA10”, follow the below Path

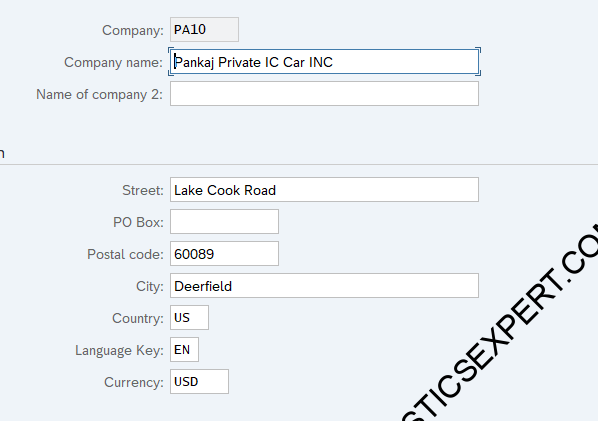

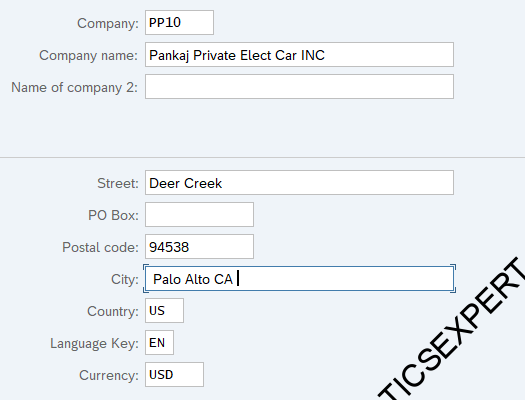

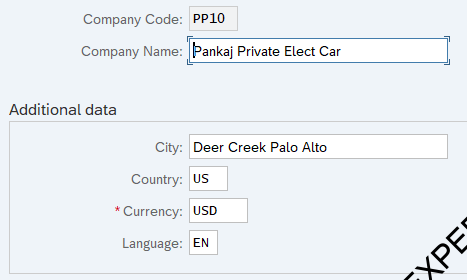

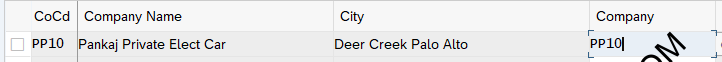

4.1.2. Company 2 – Cars with Electrical Engines

This company is named “PP Elec car INC” is based in US in Palo Alto

| Co.Code | PP10 | Description-Pankaj Private Elect Car INC | Address-Deer Creek , Palo Alto |

| Plant | PP10 | Description-PPELC Fremont Plant | Address-Fremont Boulevard |

4.1.2.1 Configuration of 2nd Company in SAP S4 HANA

Follow the below Path

Note

You can download the excel file from the below link to copy paste the values of all the steps while doing configuration

4.2 Step 2: Company Code Configuration

Company Code Configuration in SAP is a critical step for enabling financial transactions, legal reporting, and SAP FI integration.

To configure a Company Code, use Transaction Code: OX02, enter the Company Code, Name, Country, Currency, and assign it to a Company.

This setup is essential for accounts payable (AP), accounts receivable (AR), asset accounting (AA), and tax compliance. A properly configured Company Code ensures seamless SAP FI-CO, MM, and SD integration, optimizing financial reporting and global business operations.

4.2.1 Configuration of First Company Code

Follow the below path

4.2.2 Configuration of Second Company Code

Follow the below path

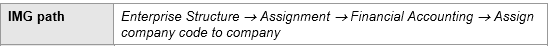

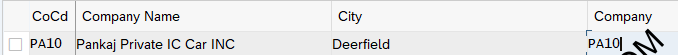

4.3 Step 3: Assign Company Code to Company

Assigning a Company Code to a Company in SAP is essential for enabling financial consolidation, intercompany transactions, and legal reporting.

To complete this setup, use Transaction Code: OX16, select the Company Code, and link it to the Company.

This ensures seamless SAP FI integration, allowing accurate accounts payable (AP), accounts receivable (AR), and tax reporting. A properly assigned Company Code supports global financial operations, multi-entity accounting, and SAP S/4HANA Finance capabilities like real-time reporting and automated compliance tracking

Follow the below path

Company “PA10” is assigned to Company Code “PA10”

Company “PP10” is assigned to Company Code “PP10”

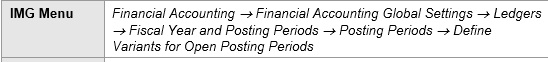

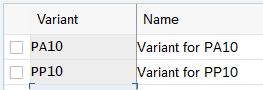

4.4. Step 4: Define Variants to Open Posting Periods

Defining Variants to Open Posting Periods in SAP is essential for controlling financial transaction postings within specific periods, ensuring accounting accuracy and compliance.

To configure this, use Transaction Code: OB52, create a posting period variant, and assign it to relevant Company Codes.

This setup prevents unauthorized postings outside defined periods, enhancing financial control, audit compliance, and SAP FI-CO integration. Businesses using SAP S/4HANA Finance benefit from automated period management, real-time financial monitoring, and AI-driven compliance tracking.

A posting period variant must be assigned to each company code since the opening and closing of posting periods takes place for each posting period variant.

Follow the below path

Two variant defined each for our both company codes

Note

You can download the excel file from the below link to copy paste the values of all the steps while doing configuration

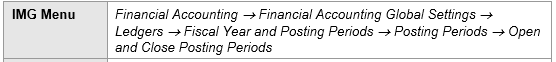

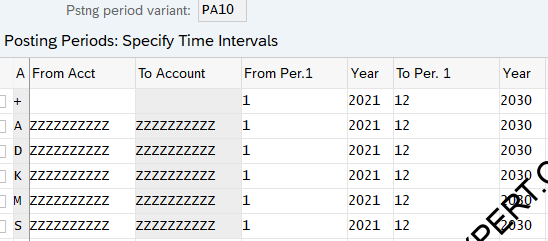

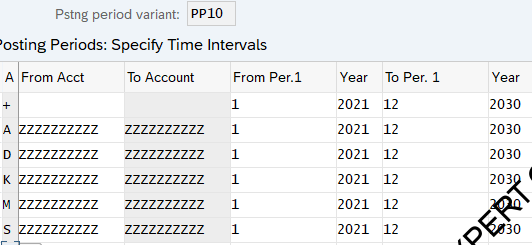

4.5 Step 5: Open and Close Posting Periods

In this activity, you can specify which periods are open for posting for each variant.

we are opening period from 2021 01 to 12 2030 for all type of GL accounts

4.5.1 FI Period Open for PA10

4.5.2 FI Period Open for PP10

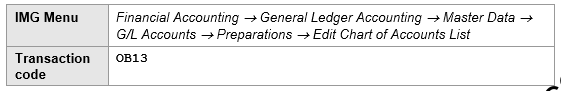

4.6 Step 6: Configure Chart Of Accounts

Configuring the Chart of Accounts (COA) in SAP is crucial for structuring financial transactions, general ledger (G/L) accounts, and statutory reporting.

To set up a COA, use Transaction Code: OB13, define the COA key, description, and language, and assign it to the Company Code (OB62).

A properly configured COA ensures seamless SAP FI integration, cost accounting, and multi-entity financial consolidation. Businesses using SAP S/4HANA Finance benefit from real-time financial reporting, automated account management, and AI-driven insights for better decision-making

COA Name – PPIN – Pankaj Private Inc

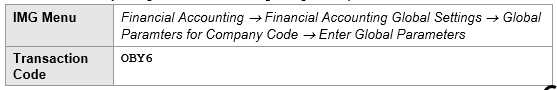

4.7 Step 7: Enter Global Parameters for Company Code

Entering Global Parameters for a Company Code in SAP is essential for defining currency, fiscal year variant, posting period variant, and field status variants, ensuring accurate financial transactions and compliance.

To configure this, use Transaction Code: OBY6, enter the Company Code, and assign the relevant global parameters. Proper setup ensures seamless SAP FI-CO integration, automated financial reporting, and tax compliance.

Now enter all the global parameters for both of our company codes as shown below

We will configure now global parameter one by one for our both the companies

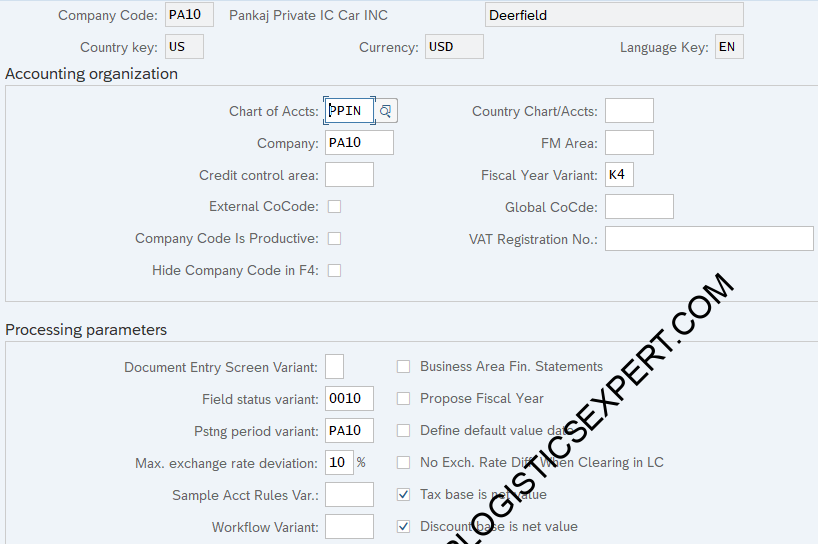

4.7.1 Configuring Global Parameter for PA10 Company Code

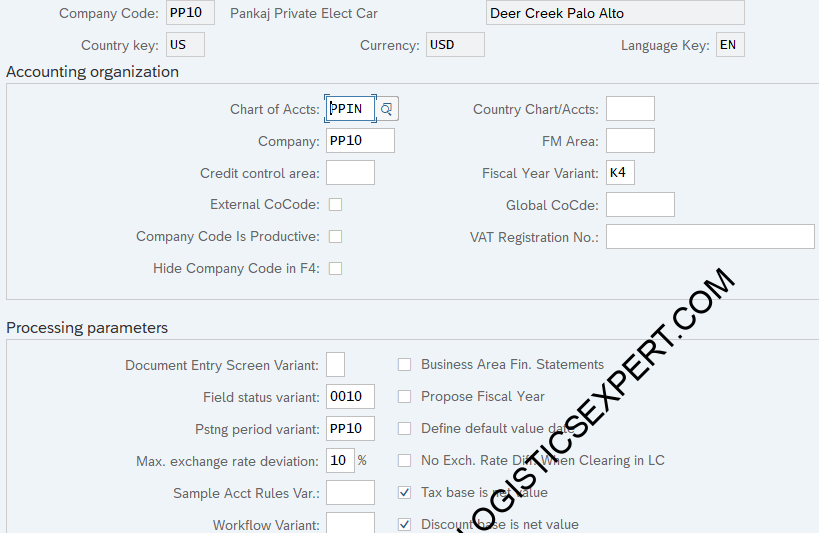

4.7.2 Configuring Global Parameter for PP10 Company Code

Please see below the details of Global Parameters entered in the above screens for both of our group companies.

| Accounting organization | Config | Detail |

| Chart of accts | PPIN | Created in earlier steps |

| Fiscal Year Variant | K4 | General Value |

| Processing parameters | ||

| Field status variant | 0010 | General Value – “Field Status GL Accounts” |

| Pstng period variant | PA10 or PP10 | Created in earlier steps |

| Max. Exchange rate deviation | 10% | max 10% allowed |

| CoCd->CO Area | 2 | Cross Co.Code. |

| Negative postings | Deselected | Negative Postings Not allowed |

| Enable amount split | NA | |

| Tax base is net value | Selected | tax is calculating net of invoice value and discount. ($100 – $3 discount = $97.00 and on that tax will be calculated) |

| Discount base is net value | Selected | We cannot tick only the “Tax base is net value” without “Cash discount base is net value” |

| Tax Reporting Date Active | Selected |

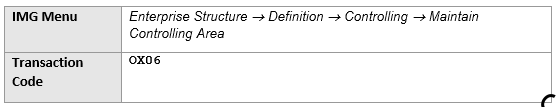

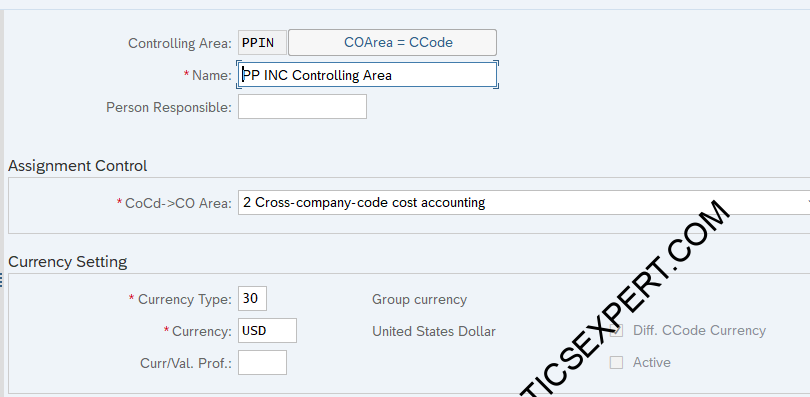

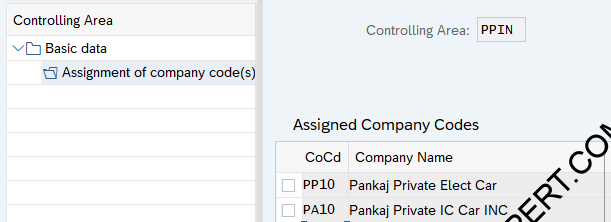

4.8 Step 8: Create Controlling Area

Creating a Controlling Area in SAP is essential for managing cost accounting, internal reporting, and financial integration across multiple company codes.

The Controlling Area serves as the backbone of SAP CO (Controlling) module, enabling businesses to track cost centers, profit centers, and internal orders efficiently. To set up a Controlling Area, navigate to Transaction Code: OKKP, define the Controlling Area key, assign Company Codes, and configure currency settings.

Proper configuration ensures seamless integration with SAP FI (Financial Accounting), MM (Materials Management), and SD (Sales & Distribution), optimizing cost tracking, budgeting, and profitability analysis. For best results, businesses should leverage SAP S/4HANA Finance to automate real-time cost allocations and predictive financial insights.

To configure the controlling area, follow the below path

Create controlling area “PPIN” as per screenshot below. Please note that to avoid errors in material ledger related to currency in S4HANA, Group currency given here in controlling area and Group currency given in SCC4 should be aligned. Please read more about activation of Material Ledger through the post How to activate Material Ledger in S4HANA in 5 Easy Steps

4.8.1 Assign Controlling Area to Company

Assigning a Controlling Area to a Company Code in SAP is a crucial step for enabling cost tracking, financial reporting, and cross-module integration within SAP FI (Financial Accounting) and CO (Controlling).

To complete this setup, use Transaction Code: OKKP, select the Controlling Area, and link it to the relevant Company Codes. This ensures seamless cost center accounting, profit center reporting, and internal order management, allowing businesses to analyze cost flows and profitability in real time.

A properly assigned Controlling Area is essential for SAP FI-CO integration, material valuation (MM), and revenue tracking (SD). For enhanced financial performance, organizations can leverage SAP S/4HANA Finance to automate cost allocations and predictive analytics for better decision-making.

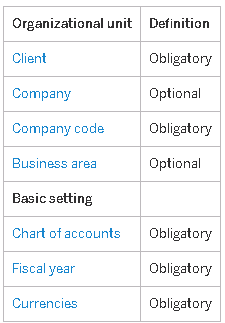

Appendix: Mandatory & Optional Finance Organization Structure

Below is the list of mandatory & optional elements of finance Organization structure

Courtesy : SAP Help. Click Here to read more

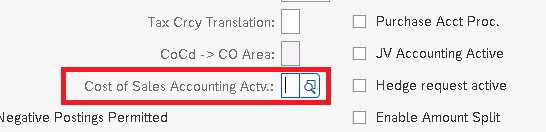

Please note that if you are making Business area as optional then in the configuration of global parameter of company code , Select the value of “Cost of Sales Accounting Active” as blank as shown in below screenshot

Note

You can read 5 Minutes guide for SD Organization Structure HERE

You can read 5 Minutes guide for MM organization structure HERE

None. This is the starting post of our journey to configure our own SAP S4 HANA working system in the minimum possible configuration efforts.

.

In the next post we will configure minimum possible SD organization structure required to run our business scenarios. Click on the above link to read in detail