MM deals with quantity and FI deal with value. So in simple term S4 HANA FI-MM integration is orchestration between quantity & value.

Basically FI-MM integration represents the posting the values automatically in tandem with different quantity movements, like -Goods receipt, goods issue to production, scrapping etc.

In this post of ultimate guide to configure S4 HANA MM-FI Integration, we will configure FI integration for all the scenarios once by one

Note : This post is to configure MM-FI integration leaving automatic GL determination (OBYC).

For OBYC settings in detail please see the below post

The Ultimate Guide to Master SAP MM-FI Integration

--> MM-FI integration is configurations relevant to transactions in Inventory Management (for example, goods movements ) and in Invoice Verification (for example, invoice receipt for automatic postings to G/L accounts in Financial Accounting and Cost Accounting). --> In this post we will configure MM-FI integration through a new , quick & innovative concept. We will start the process and configure the system on the way as & when system throws error because of absence of MM-FI integration configuration.

Table of Contents

1. Preparation for S4 HANA MM-FI Integration

We will create the Purchase order first and then post the Goods Receipt. At the time of goods receipt, system posts the respective amount to the corresponding GL account. This is MM-FI integration area.

System will guide us (through errors) for the missing FI-MM configuration. We will configure MM-FI integration accordingly.

1.1 Base Price in Purchase Order

There are two condition types in Purchase order PB00 & PBXX which decided the base price.

1.1.1 PB00

Maintained through condition records in turn through access sequence gets fetched ( ie through Info record ) also this is a time dependent condition.

1.1.2 PBXX

This particular condition is maintained whenever the rate of the material in the PO is to be maintained manually as there no condition records exists for this. This condition is free from access sequence also it does not possess any validity thereby we can call this condition type as a time independent condition.

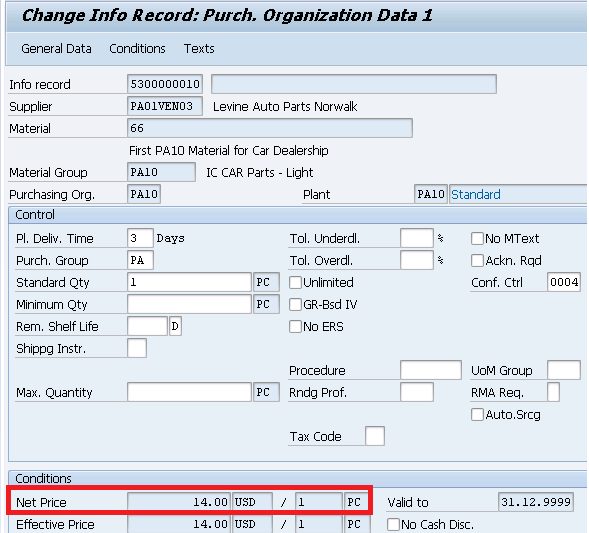

Let’s create info record

1.1.3 ME11

1.2 Create Purchase Order

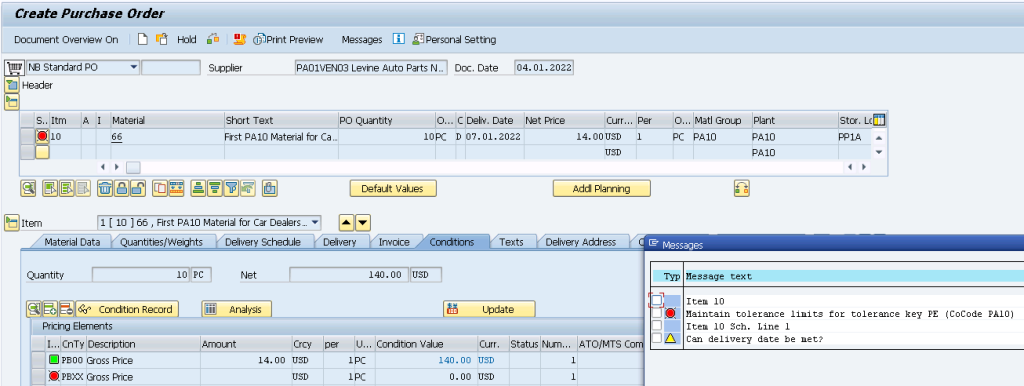

Start ME21N

Hint

Storage Location flowing in PO from the Material Master MRP2 view. Please click HERE for more detail

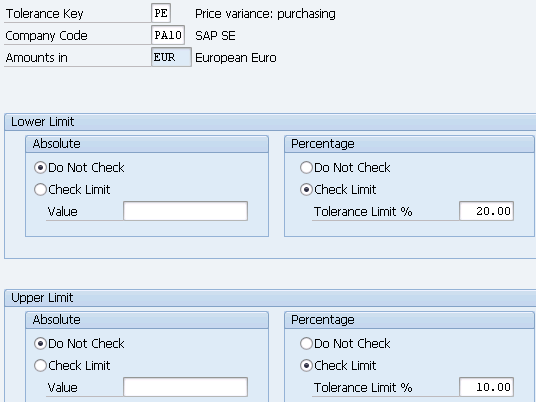

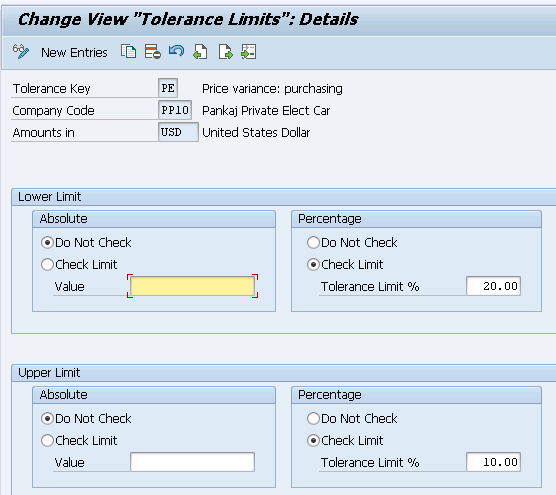

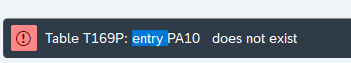

1.2.1 Error M8215 -Maintain tolerance limits for tolerance key PE

Go to SPRO -> Purchasing -> Purchase Order -> Set Tolerance Limits for Price Variance

Maintain the tolerance limit for both the keys PE & SE for both the company codes

1.2.1.1 Tolerance Key (PE) – Price variance: purchasing

Maintained for PA10 Company

Similarly Maintained for PP10 Company

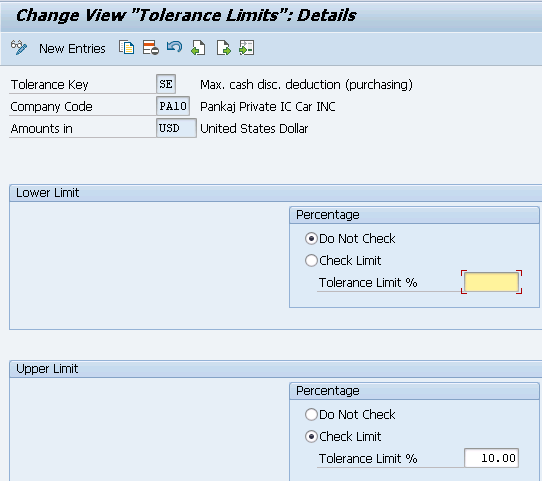

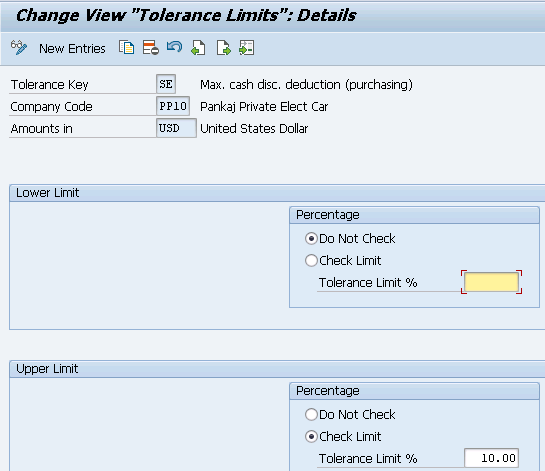

1.2.1.2 Tolerance Key (SE) – Max. cash disc. deduction (purchasing)

Maintained for PA10 Company

Similarly maintained for PP10 Company Code

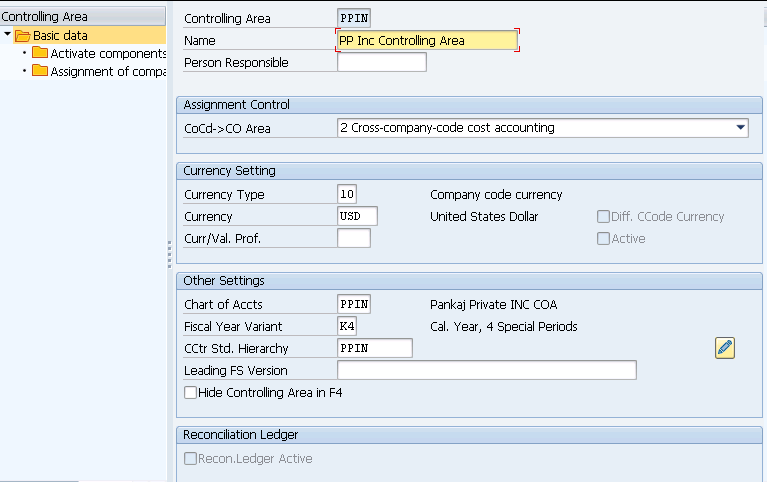

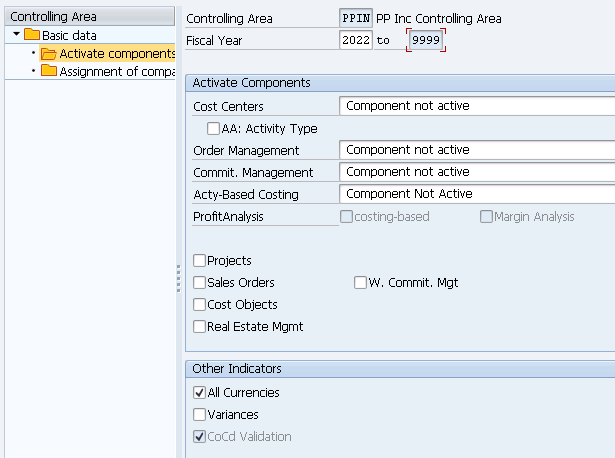

1.2.2 Error KI102-Control indicators for controlling area PPIN do not exist

To resolve this error, activated components for fiscal year 2022 in OKKP

1.3 Price in PO

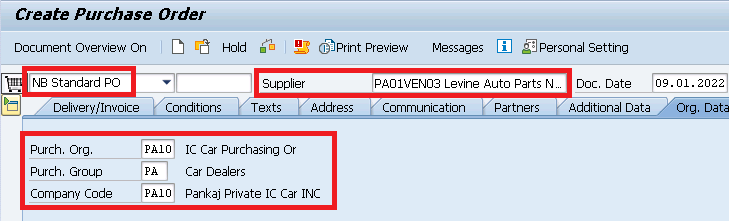

Create the Purchase order as per the below data

- Purchasing Document Type – NB (Standard)

- Vendor-PA01VEN03 (Levine Auto Parts Norwalk)

- Purch.Org-PA10

- Purchasing Group -PA

- Company Code -PA10

- Plant -PA10

- SLOC-PP1A (Defaulted from Material Master)

- PO Quantity – 1 PC

- Price – 14 USD/PC (From info record)

- Conf. Control Key -0004

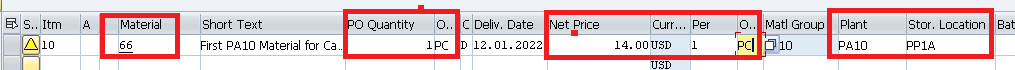

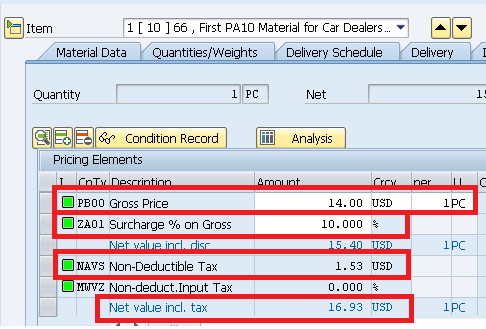

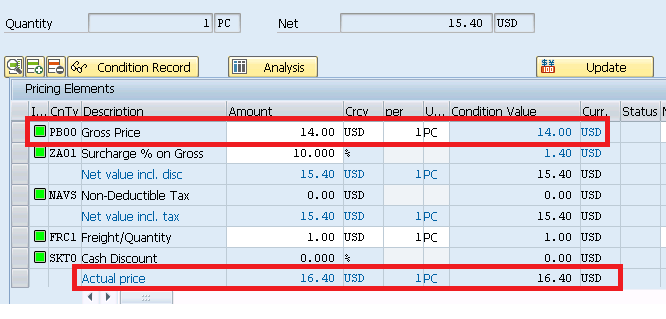

Final price is calculated in PO as per below components

1.3.1 Price Components

Let,s consider below price components

- Price of 14 USD per piece is coming from purchasing Info-record

- Manual input surcharge condition “ZA01” as 10%

- Enter Freight “FRC1” condition manually Freight/Quantity 1 USD/PC

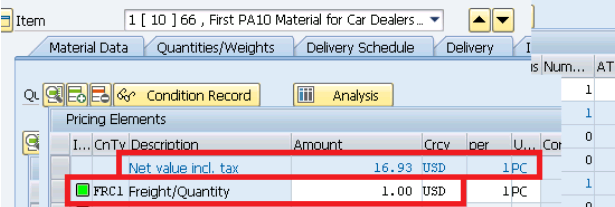

1.3.2 Planned Distribution Cost

Planned delivery costs are delivery costs (incidental procurement costs) agreed with a vendor, a forwarder or carrier, or a customs office before the purchase order is placed

Since planned delivery cost are known at the time of purchase order creation so we an enter planned distribution cost in the PO which then subsequently take part in the accurate calculation of material landing cost.

In our example PO, we are entering freight cost which is agreed with vendor as 1 USD/PC in advance. This is planned delivery cost.

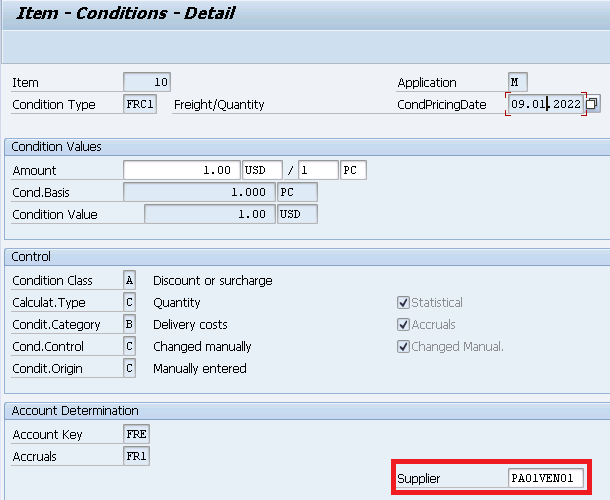

1.3.2.1 Freight Vendor

Since we are entering freight cost so we can enter a separate freight vendor also.

To enter freight vendor select the freight condition FRC1 and click on detail.By default main PO vendor (PA01VEN03) is entered in the vendor field but we can change it to the separate freight vendor.

This is planned distribution cost.

We have created a freight vendor PA01VEN01 for freight execution. Let,s enter this vendor in the freight condition type.

1.4 Taxes in Purchase Order

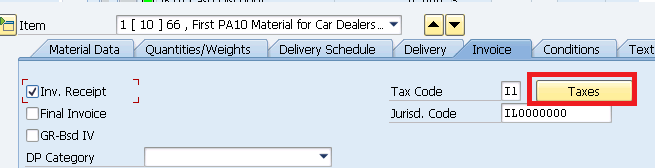

Taxes are calculated automatically in PO as per tax code which is determined automatically in Purchase Order

Please see the below post to check the configuration of TAX procedure

How to configure input Tax in S4 HANA in 7 Easy Steps

Go to “Invoice” Tab on item level. System has determined Tax code automatically as “I1”. Click on “Taxes”

System will show how taxes are calculated

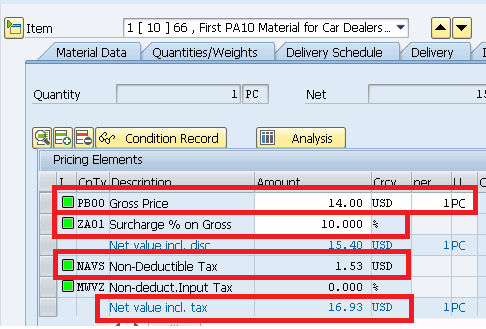

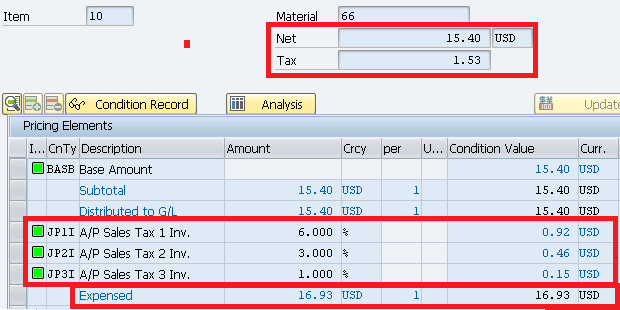

As per our pricing schema BASE for calculating tax is now 15.4 USD after 10% surcharge.

This calculation of tax of USD 1.53 is brought into PO MM price determination procedure (Picture Below) from the FI Tax determination procedure (Picture Above) through condition NAVS (full details are HERE) to calculate the total value of material.

1.5 Calculation of Final Price in PO after Surcharge, Freight & Tax

System calculates landing price as per below table. This is the price which will be loaded on material valuation

Base Price (from Info Record) =14 USD / PC

Surcharge (Manually Entered) =1.4 USD / PC (10%)

--------------------

Net Value (Base for Taxes) =15.4 USD / PC

---------------------

A/P Sales Tax 1 Inv. 6.000 % = 0.92 USD

A/P Sales Tax 2 Inv. 3.000 % = 0.46 USD

A/P Sales Tax 3 Inv. 1.000 % = 0.15 USD

--------------------

Total Tax = 1.53 USD

--------------------

Net Value (Including Taxes) = 16.93 USD / PC

--------------------

Freight (Manually Entered) = 1 USD / PC

_______________________________________________

Actual Price = 17.93 USD / PC

_______________________________________________

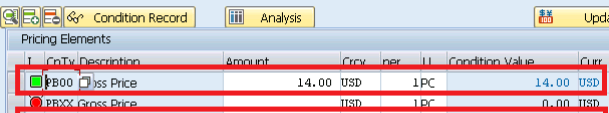

Condition type PBXX appears with red status in condition tab at the time of creating a Purchase Order

1.6 Resolution of Red indication of PBXX Condition Type

If PBXX is indicating in red as shown below

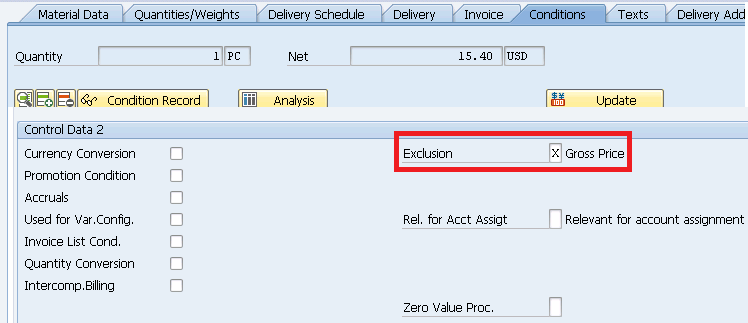

Set the exclusion indicator (field V_T685A-KZNEP) in transaction M/06 for condition type PB00

Now PBXX is removed as soon as system found the price for PB00.

HINT

Please see the below post to check the configuration of above Pricing schema

Ultimate Guide to MM Pricing in 5 Easy Steps

Now save your PO. System will give message with created PO number.

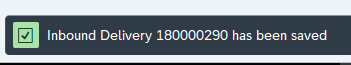

Now Create Inbound delivery as we have given a confirmation control key . We will cover delivery topic separately

2. FI-MM Integration starts From Here

We will start receipting the goods into the system. We will configure the system on the way as & when system throws error because of absence of MM-FI integration configuration. This is a quick & innovative method to configure MM-FI integration.

2.1 Good-Receipt

Since we have not configured FI-MM configuration part till yet, so system will throw errors. We will resolve error one by one till we are successful in posting goods receipt.

Start MIGO and prepare for goods receipt against your PO/Inbound Delivery

2.2 First Error – Missing Logistics Invoice Verification Configuration

This error is due to missing configuration related to Invoice verification

Please follow the below post to complete the Logistics invoice verification

How to Configure Logistics Invoice Verification in SAP S4 HANA

Now try to post goods receipt again

Try to post the GR again

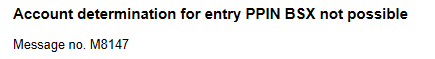

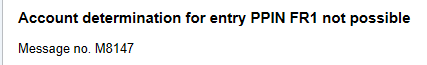

2.3 Second Error M8147 – BSX

BSX is the transaction key used for all postings to stock accounts through configuration OBYC

Please check below post to see BSX configuration in detail

The Ultimate Guide to Master SAP MM-FI Integration – Scenario 1 :Goods Receipt Against Standard Purchase Order

Now try to post goods receipt again. The system throws the next error

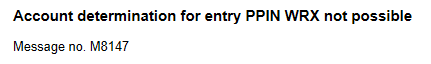

2.4 Third Error M8147 – WRX

Now we need to configure WRX key (GR/IR) same as we did for BSX. Choose the GL from our downloaded GL master

Please check below post to see WRX configuration in detail

The Ultimate Guide to Master SAP MM-FI Integration – Scenario 1 :Goods Receipt Against Standard Purchase Order

Now try to post goods receipt again

2.5 Fourth Error M8147 – FR1

In our PO we have given Freight (Condition “FRC1”) as 1 USD per PC so system is searching corresponding GL to post it to FI

System is searching for Key FR1 because in our pricing schema we have used key FR1 for condition “FRC1”.

Please check the pricing schema from the link to the post given below

Ultimate Guide to MM Pricing in 5 Easy Steps

Please check below post for FR1 configuration

The Ultimate Guide to Master SAP MM-FI Integration – Scenario 1 :Goods Receipt Against Standard Purchase Order

Now try to do goods receipt again

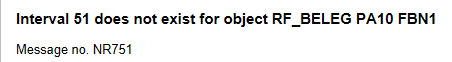

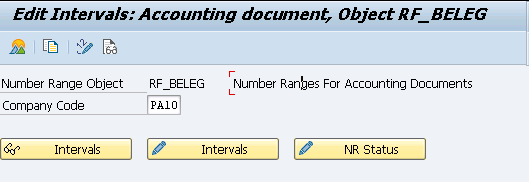

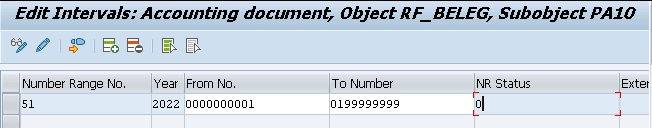

2.6 Fifth Error NR751 – Interval 51 for Object RF_BELEG

Maintained Number range for our both company codes PA10 & PP10

Start FBN1

Now try to post Goods Receipt again

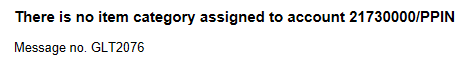

2.7 Sixth Error GLT2076 – Document Splitting

This error is due to document splitting

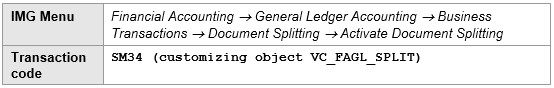

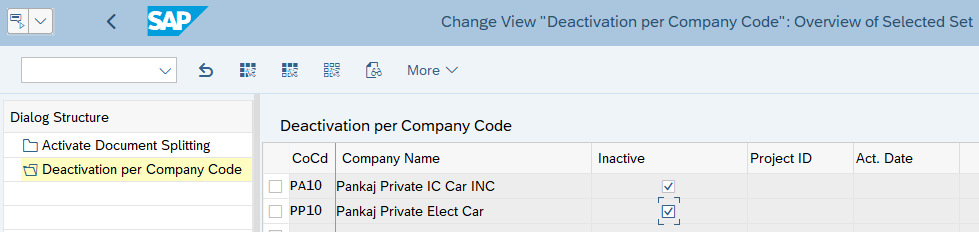

2.7.1 De-activate Document Splitting

We can deactivate Document splitting for our company code. We need to deactivate this for both company codes, otherwise cross company code transactions are not possible if settings for document splitting is different.

Now try to post Goods Receipt

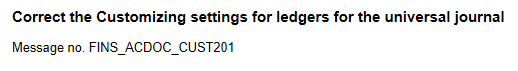

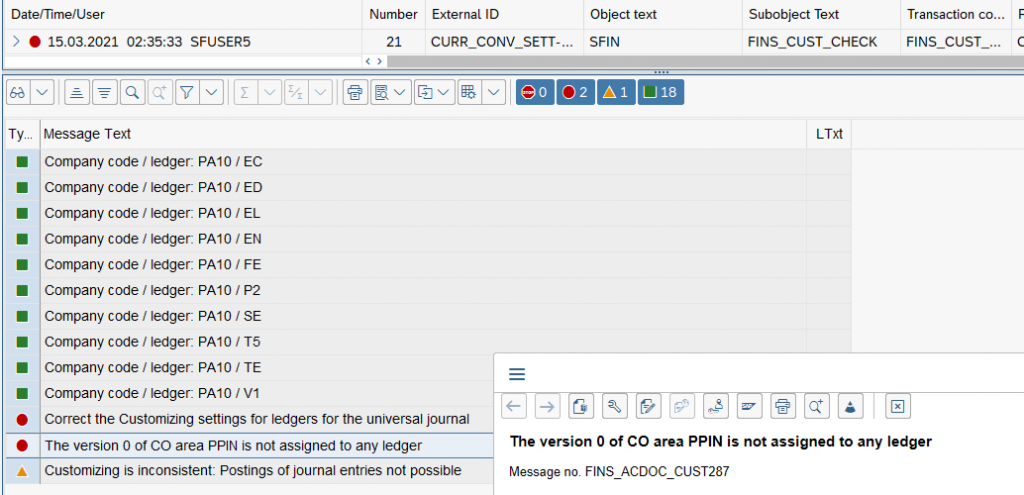

2.8 Seventh Error : FINS_ACDOC_CUST201

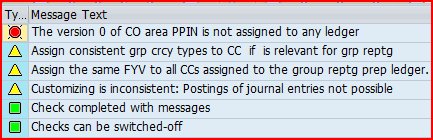

To resolve this error run FINS_CUST_CONS_CHK_Q. The error is given below

ERROR FINS_ACDOC_CUST287

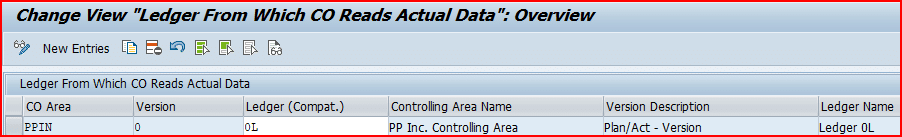

Assign the version 0 of CO area PPIN

Start MIGO again and try to do GR.

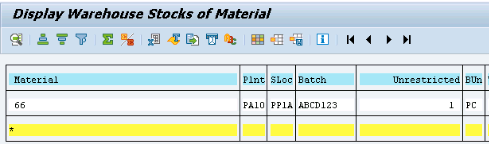

GR is created successfully and batch “ABCD123” created (Material is batch managed)

Finally Goods Receipt is posted for our First PO

2.9 Eight Error : GL requires an account assignment relevant to cost accounting(KI235)

Please click HERE to see the detail resolution of this error

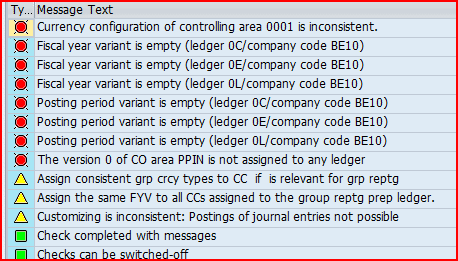

2.10 Ninth Error : Error Message No. FINS_ACDOC_CUST205

Now system is throwing error “For CoCode PA10, version 000, there is no entry in table FINSC_CMP_VERSNC.”

--> To resolve this error Execute "Consistency Check of General Ledger Settings" T code "FINS_CUST_CONS_CHK"

System has presented the below log

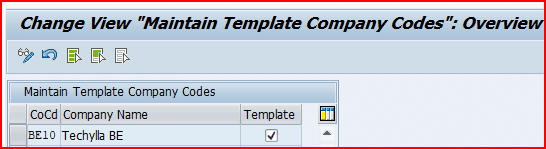

Since we are not going to use company code BE10 & 0001 so, we are taking the easy path of switching off the check

--> Switch off the check for the company code(s) (which are not used) given in the above log through T-code FINSC_CO_CD_TEMPLATE

Now after switching off the checks, run the T-Code “FINS_CUST_CONS_CHK” again . Log is very small which is only relevant to our company code/controlling area.

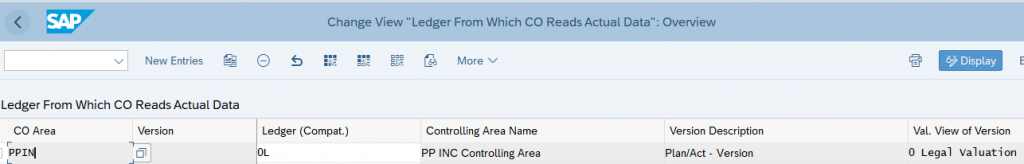

To resolve this error go to T-Code “Define Ledger for CO Version”

2.9 GR Posting

Since all errors are removed now GR is posted successfully.

--> Once all errors are removed then GR is posted . --> Material is received in stock. --> Material document is posted --> FI Document is posted in the background automatically

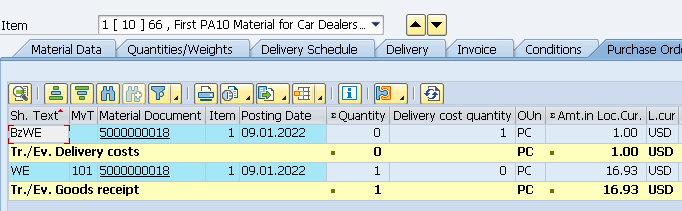

2.9.1 PO History Update

As soon as we post the goods receipt, system updates “Purchase Order History” tab.

2.9.1.1 “BzWE”- Short text for material document in PO History

Since we have maintained values for freight condition in purchase order, then while doing GR, system enters GR document for this also – document type generated is BzWe for conditions and for goods it is WE

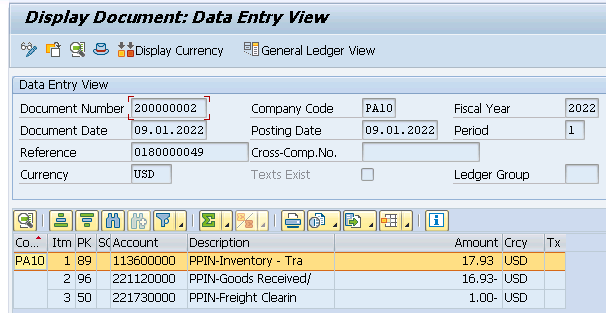

2.10 FI Postings (MM-FI Integration)

System creates a material document to update the quantity in the Plant/SLOC. On the back of it, system generates an accounting document.

2.10.1 Reminder -Check the FI document above in light of the PO Pricing

2.10.1.1 PO Pricing

Below is the pricing in our Purchase order

Base Price (from Info Record) =14 USD / PC

Surcharge (Manually Entered) =1.4 USD / PC (10%)

--------------------

Net Value (Base for Taxes) =15.4 USD / PC

---------------------

A/P Sales Tax 1 Inv. 6.000 % = 0.92 USD

A/P Sales Tax 2 Inv. 3.000 % = 0.46 USD

A/P Sales Tax 3 Inv. 1.000 % = 0.15 USD

--------------------

Total Tax = 1.53 USD

--------------------

Net Value (Including Taxes) = 16.93 USD / PC

--------------------

Freight (Manually Entered) = 1 USD / PC

_______________________________________________

Actual Price = 17.93 USD / PC

_______________________________________________

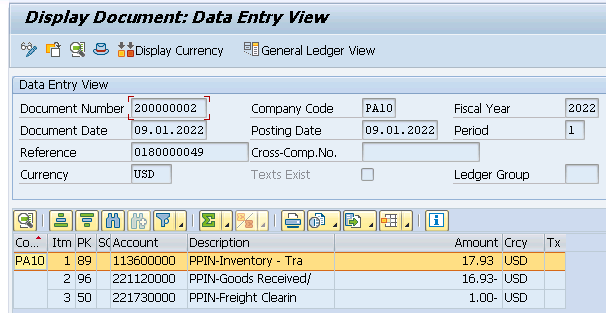

2.10.1.2 FI Postings

FI Posting is done as per our configuration in alignment with PO price components

Posted on inventory (Landed / Actual Price) = 17.93 USD (+) Posted on GR/IR account = 16.93 USD (-) Posted on Freight clearing Account = 1 USD (-)

2.11 Stock is now present in Plant PA10

3. Loading the Stock through MIGO/561

When we load the stock through 561 movement type, system posts the corresponding amount on the GL in the background.

Please check the below post for the detail

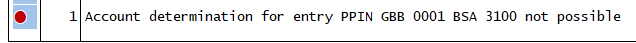

system throws below error in the absence of FI configuration

3.1 ERROR M8147

Check the below post to resolve this error

The Ultimate Guide to Master SAP MM-FI Integration – Scenario 2: Initial Stock Load

Image by mamewmy on Freepik

In the previous post we have configured SAP MM Pricing procedure which is a prerequisite to configure FI-MM Integration. Please click on the above link to see the details.

After FI-MM Integration configuration completion, the subsequent activity is Logistics Invoice Verification configuration. Please click on the above link to see the details

Image Courtesy : Background vector created by rawpixel.com – www.freepik.com